Take Control Of Your Keys

Self-custodying bitcoin. What is it and why its important.

Abhilash S Nair

September 9, 2025

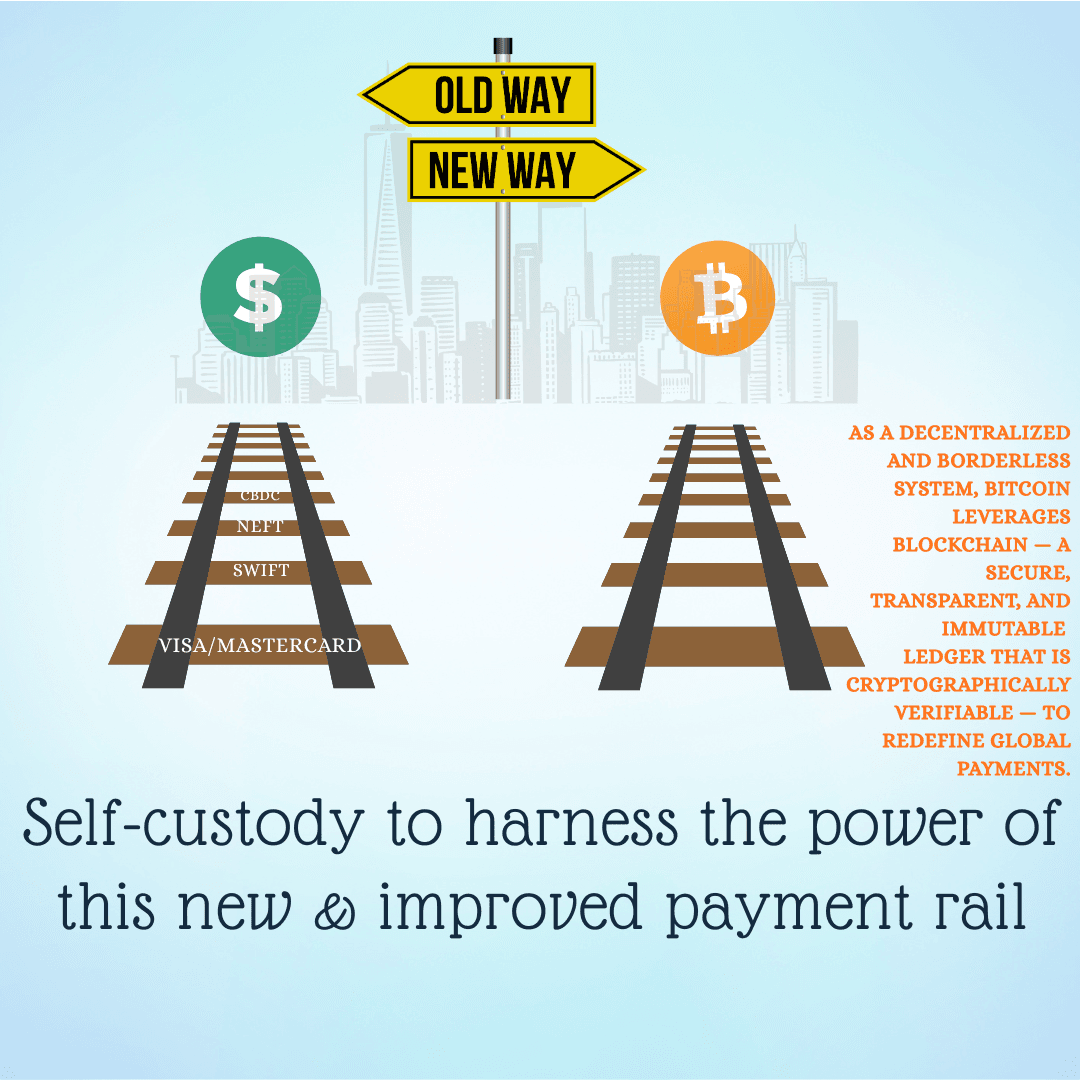

In the world of traditional finance, we’re used to relying on intermediaries—banks, brokers, and payment processors—to hold and move our money. But bitcoin was built on a radically different foundation. It was designed to give you, the individual, full control of your wealth without needing to trust third parties.

The key to unlocking that promise lies in one simple principle: Self-custody.

What is self-custody?

When you self-custody your bitcoin, you hold it in a wallet where you control the private keys—the cryptographic keys that prove ownership and allow you to spend your coins.

This means:

✅ No exchange can freeze your account

✅ No custodian can go bankrupt and take your assets

✅ No government can arbitrarily seize your holdings

“Not your keys, not your coins” isn’t just a catchy phrase—it’s a foundational tenet of managing your bitcoin.

The FTX collapse and countless other exchange failures have proven why this principle matters. Bitcoin’s true strength comes from decentralization, and when you self-custody, you actively reinforce that system of resilience and independence.

Security, Sovereignty & Legacy

Self-custody isn’t just about protection—it’s about freedom and flexibility.

When you own your keys, you can:

✅ Set up multi-signature wallets to eliminate single points of failure

✅ Distribute backups across multiple secure locations

✅ Use time-locked wallets to plan inheritance for your loved ones

These tools aren’t usable when your bitcoin sits on an exchange, waiting to be unlocked at someone else’s discretion.

“You are your own bank—secure it like one.”

Yes, self-custody means taking on responsibility: safeguarding your seed phrase, learning how wallets work, and preparing for contingencies. But the reward is worth it. You’re not just securing your wealth; you’re opting out of a system that prioritizes middlemen over individuals.

🚀 The Future Belongs to Those Who Hold Their Keys:

As Bitcoin adoption grows, traditional financial institutions will continue to package bitcoin into familiar custodial products. The temptation to take shortcuts will rise.

But bitcoin’s real innovation isn’t about fitting into the old system—it’s about building a new one where you are in control.

Self-custody ensures your bitcoin remains:

✅ Censorship-resistant

✅ Portable

✅ Fully yours

“When you hold the keys, you have agency over your future.”

So ask yourself: Who really holds the keys to your bitcoin?

When you do, you’re not just protecting your assets—you’re embracing the full potential of what bitcoin was built to be.

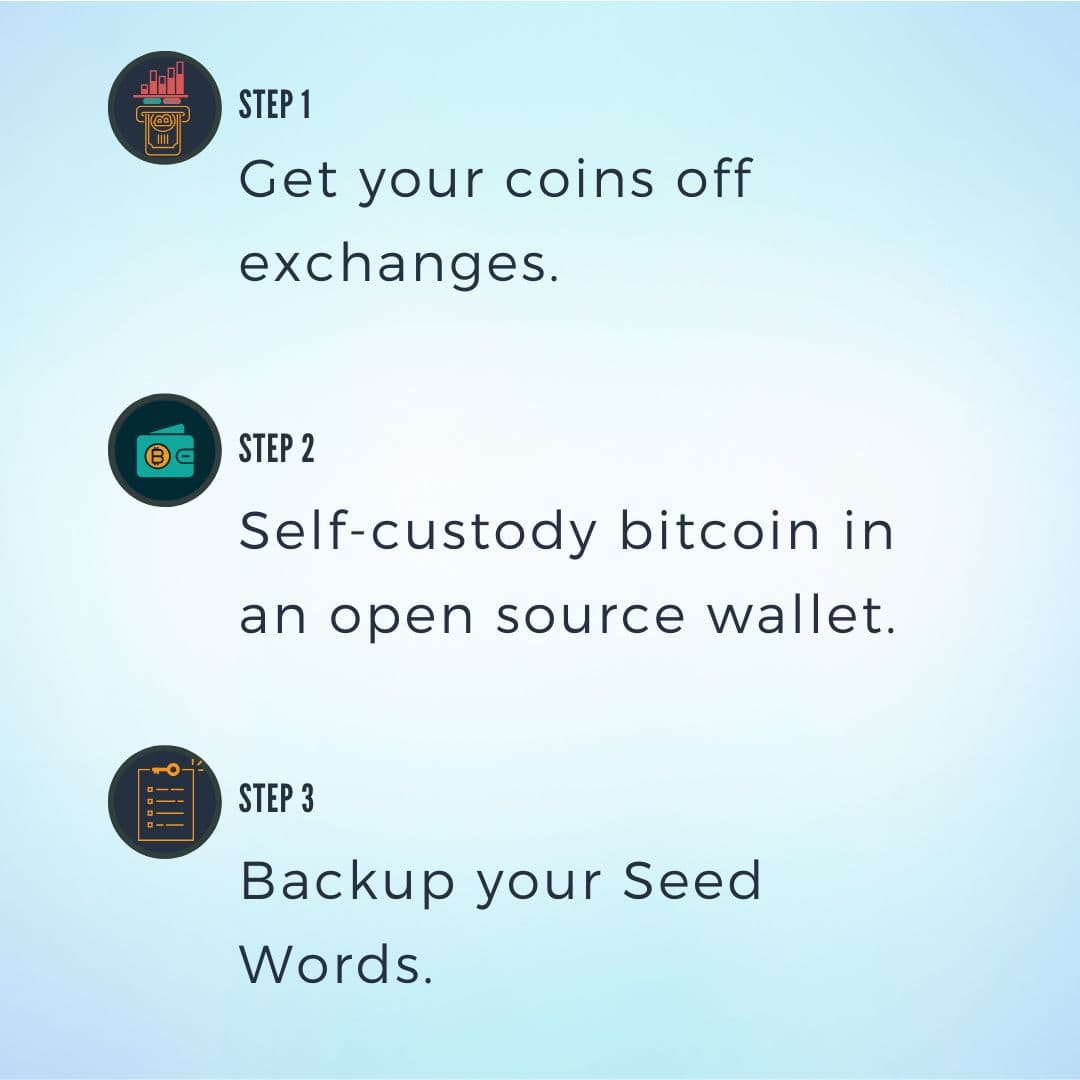

Ready to take control?

Check out our blog on software wallets for the first steps, and if you need help at any step of the way please reach out to us here.