Bitcoin Inheritance Planning

Protecting Your Wealth for the Next Generation.

Abhilash S Nair

September 17, 2025

Unlike traditional assets, there’s no bank or legal executor who can "reset your password" or retrieve your bitcoin for your loved ones. Without a plan, your wealth could be lost forever. Bitcoin inheritance planning ensures that your family is protected and your hard-earned bitcoin legacy survives.

Why Inheritance Planning Matters

Having a robust inheritance plan ensures that:

- Heirs have secure and legal access to your bitcoin.

- You avoid the risk of your holdings being lost due to missing seed phrases or wallet files.

- Your wealth is transferred legally and cleanly, respecting both title and possession.

Bitcoin doesn’t care who owns the keys—whoever holds them, owns the coins.

Title vs. Possession: A Crucial Distinction

In traditional estate planning, title (who legally owns the asset) and possession (who physically controls it) often align because banks and custodians enforce both. But with bitcoin, this distinction is critical:

- Title: Legal ownership as stated in your will or trust.

- Possession: Whoever has the private keys or seed phrases.

If your heir has legal title but not the keys, they can’t access the bitcoin. If someone else has the keys but not legal title, they can access it, but it may create legal disputes.Your inheritance plan must align title and possession. This often requires a bitcoin-aware estate planner, who can structure wills, trusts, and custody instructions in a way that ensures your heirs can both legally and practically access your bitcoin.

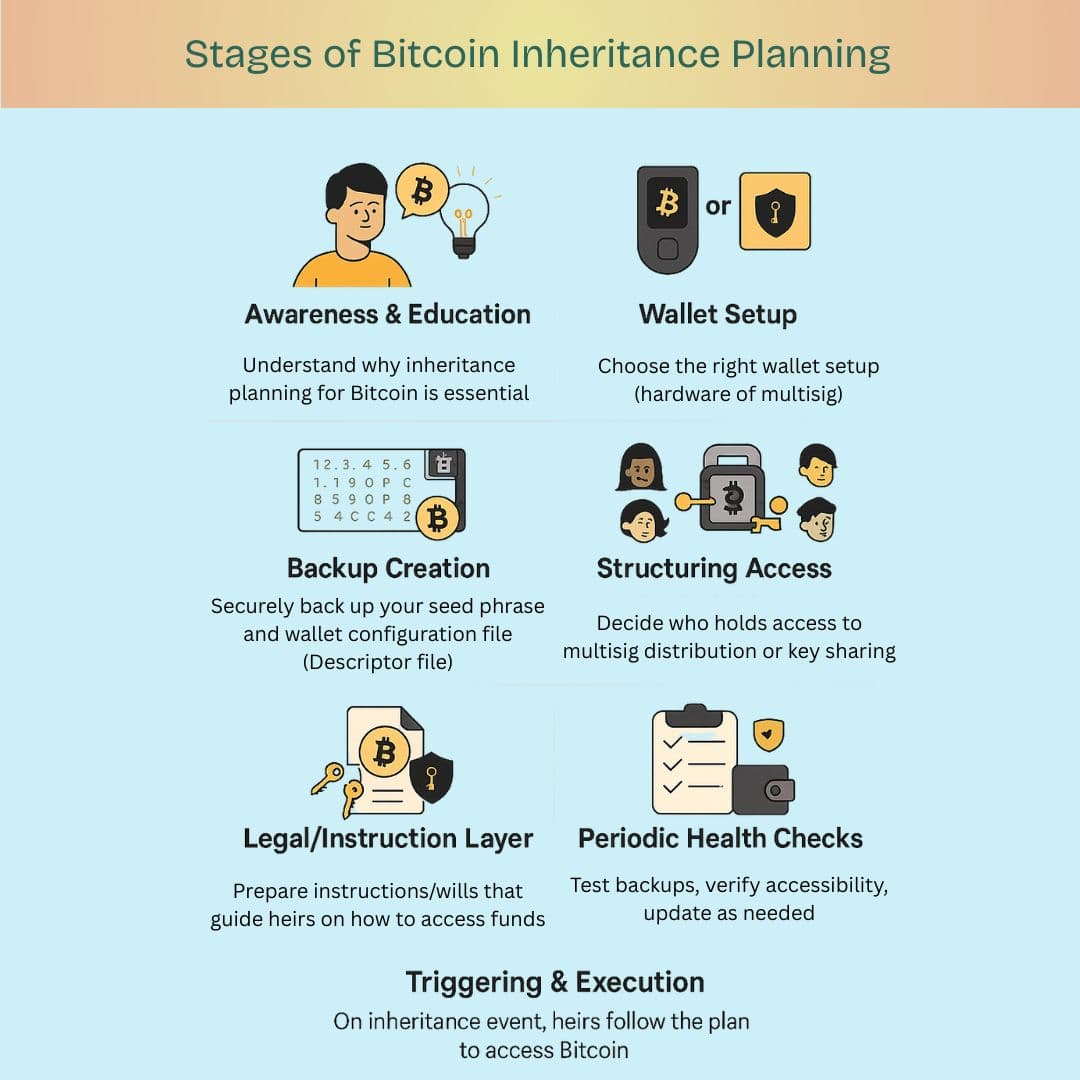

The Foundation: Self-Custody

Inheritance planning starts with self-custody. You must control your bitcoin keys before you can decide how to pass them on.

If your bitcoin is sitting on an exchange, your heirs will be at the mercy of complex legal processes (if they’re even successful).

Set up a self-custody wallet (single-key or multisig) and document where the keys, seed phrases, and wallet configuration files (for multisig) are located.

Tip: An experienced estate planner can help document these in a way that remains private during your lifetime but becomes accessible when needed.

Tools for Bitcoin Inheritance

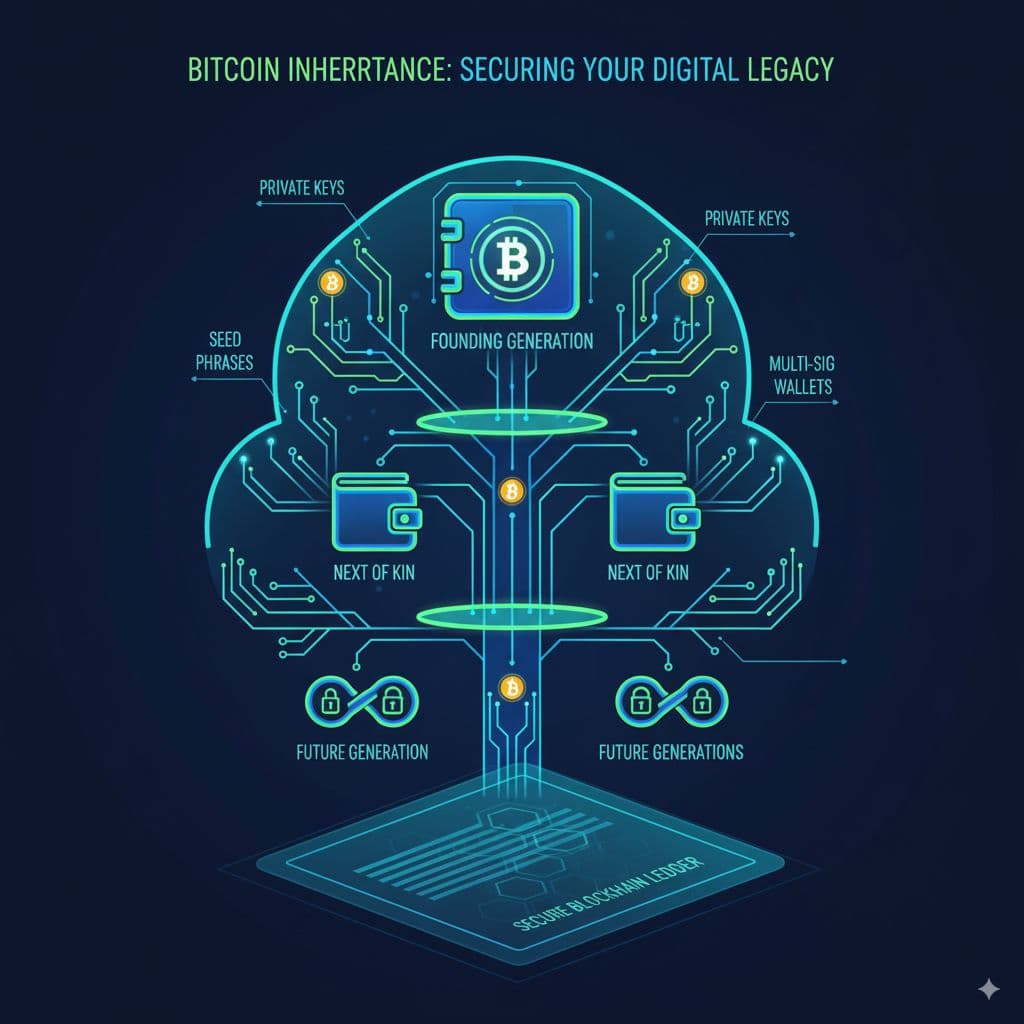

1️⃣ Seed Phrase Backups

Your seed phrase is the ultimate backup. Without it, you risk losing your bitcoin permanently:

- Store multiple copies in geographically separated secure locations.

- Use durable backup materials (like steel plates) to protect from fire or water damage.

- Include clear instructions for heirs on how to use the seed phrase.

Estate Planner's Role: They can guide you on how to legally store backup instructions in wills or trusts without compromising your security.

2️⃣ Multisig Wallets

Multisignature wallets allow you to set conditions (e.g., 2 of 3 keys required to move Bitcoin). This flexibility is powerful for inheritance planning:

- One key can go to your spouse, another to a trusted executor, and a third to a secure backup or attorney.

- The setup reduces the risk of a single point of failure or misuse.

Important: Multisig setups also require wallet configuration (descriptor) files to be backed up alongside the keys. Without this file, your heirs may not be able to reconstruct the wallet.

Estate Planner's Role: They can act as one of the key holders or ensure a trusted executor is designated to maintain legal clarity and security.

3️⃣ Time-Locked Wallets

Time-locked wallets allow your bitcoin to be accessed only after a set period. This is useful if you want heirs to receive the bitcoin after your passing or after a period of inactivity.

Timelocked wallets combined with multisig offer enhanced flexibility with the same security as a simply multisig.

Estate Planner's Role: They can help legally document the timing conditions and serve as a trusted verifier when the time-lock expires.

Writing Your Inheritance Plan

You could consider outlining the following:

- What bitcoin wallets you own.

- Where to find seed phrases, keys, and configuration files.

- How to access and move the Bitcoin (step-by-step).

- Who to contact for help (trusted executor, estate planner, or Bitcoin consultant).

Tip: Keep the plan in a sealed envelope, a will, or with your estate planner. Update it periodically.

Best Practices for Peace of Mind

- Align title and possession: Make sure your will or trust legally names your heirs, and that they will have access to the private keys.

- Test your plan: Do a dry run with your estate planner or executor to confirm they can follow your instructions.

- Don’t overshare: Only give partial information (e.g., location of one key) to each person until necessary.

- Use professionals: A bitcoin-aware estate planner can bridge the gap between technical setups and legal structures.

Review periodically: Life changes—so should your plan.

A strong inheritance plan aligns the law (title) with access (possession).

Secure Your Legacy

Bitcoin inheritance planning is about protecting your family’s future. Without a well-defined and tested plan, the wealth you’ve built could vanish forever.

Start with the basics: self-custody, backups, multisig, and legal clarity. Add layers of security and estate planning expertise as needed.

Ready to start your bitcoin inheritance plan? Document your keys, configuration files, and instructions to be followed after you. Reach out to us here if you need help setting up your bitcoin Inheritance Plan.